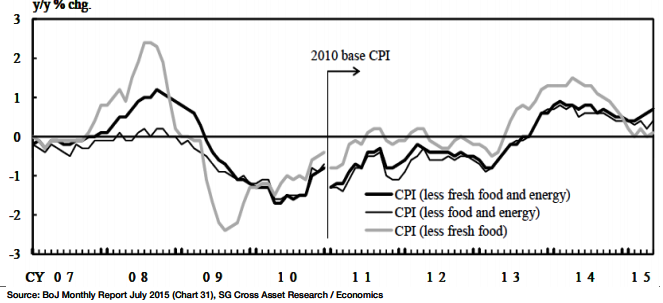

There are discussions regarding the possibility for BOJ changing the inflation target from "CPI" to "CPI excluding fresh food and energy". In the BoJ's July Monthly economic report, a chart of "CPI less fresh food and energy" was introduced for the first time.

This chart shows that by excluding energy from "CPI less fresh food", the CPI looks stronger than other indices, due to the effect of declining oil prices. As one of the BoJ's board members, Mr Ishida, mentioned in his recent speech on 30 July, the latest "CPI - less fresh food and energy" shows 0.7% yoy while "CPI less fresh food" is around 0.1% yoy.

Mr Ishida stressed that the BoJ's price stability target is a "flexible inflation targeting" and the BoJ will look at various economic and monetary conditions and will be as "flexible" as needed.

Mr Ishida also pointed out that, despite various discussions on the revisions to the CPI indices, he is not so nervous about the upcoming CPI revision compared to the previous time in 2010, as he believes that the changes will be smaller this time around.

"Whether or not to include imputed rents in the core CPI is being discussed. However, the most important point is that the BoJ would take into account various information to make monetary policy judgement. Similarly, as long as the 2% target is likely to be achieved in a foreseeable future, it does not need to be exactly 2.0% or to be achieved within the exact timing", says Societe Generale.

In any case, recent discussions on the CPI revision will not alter the BoJ and the government's commitment to achieving the price stability target.

Possibility of change in Japan's inflation target?

Wednesday, August 5, 2015 3:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX