USD was broadly firmer on Wednesday as the markets await Fed's decision, due at 1900 GMT. Traders are reluctant to take major bets and remain on the sidelines. Data yestsrday showed that U.S. core Consumer Price Index rose 2.0 percent in the 12 months through November, marking the largest gain since May 2014, giving traders more confidence that the Fed would hike rates later in the day. Investors' focus shall remain mainly on the tone of the FOMC statement, especially the press conference. Here is an overview of the possible outcomes and their effect on FX markets:

Dovish hike - the most likely outcome

The USD is likely to weaken against G10, with concerns weighing on whether the Fed tightening cycle will end early. Weakness in EM FX in 2016 will be less pronounced, EM currencies with favourable valuations, high yield and growth recovery prospects are poised to outperform.

Hawkish hike - not priced in at all

If Yellen fails to provide reassuring dovish overtones, USD is likely to gain immediately in the aftermath against the AUD and NZD. A 'risk off' mood' may be created, EM FX would be caught in the same negativity, with the BRL, COP, TRY, MYR, MXN, and the IDR vulnerable.

No hike - a risk off event

This outcome has the least clear market reaction. Yesterday's U.S. CPI data has clearly cemented a rate hike. Nevertheless, it would signal growth concerns in the US and worldwide. The USD would weaken markedly against G10. A 'risk off' mood would prevail, prolonging the agony for EM FX. The JPY would outperform, while GBP would languish with a BoE delay anticipated alongside the Fed's.

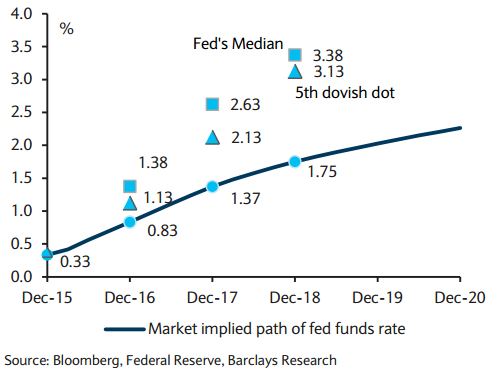

"The first Fed hike in nine years is likely to be accompanied by dovish rhetoric in the press conference, especially against a backdrop of lingering disinflationary pressures globally, a new low in oil, and fairly rapid USD/CNY depreciation", says Barclays in a research note.

Fed Chair Yellen is likely to emphasize that the FOMC remains data dependent and the path of rate hikes is not pre-determined. There are definitely no expectations for a numeric guidance about the meaning of 'gradual', but she may point to the dots as indicative, noting both upside and downside risks to the path. Yellan is also expected to reiterate that these effects are transitory and will fade over time.

EUR/USD was trading at 1.0920, while USD/JPY was at 121.99 as of 1045 GMT. US Treasury yields were up modestly, stood at 2.2711 pct, rising by 0.005 pct as markets await Fed decision.

Possible Fed outcomes and implications on FX space

Wednesday, December 16, 2015 11:35 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary