Puma anticipates a subdued start to the first half of 2024 due to continued negative currency impacts, setting the tone for the German sportswear giant. Despite the prevailing challenges, the company remains steadfast in adhering to the annual targets outlined in January.

Market Challenges Ahead

According to Yahoo, CEO Arne Freundt acknowledged the persisting difficulties in the market environment as the new year unfolds. Such challenges have necessitated a strategic approach to maintain resilience and competitiveness in the dynamic sportswear landscape.

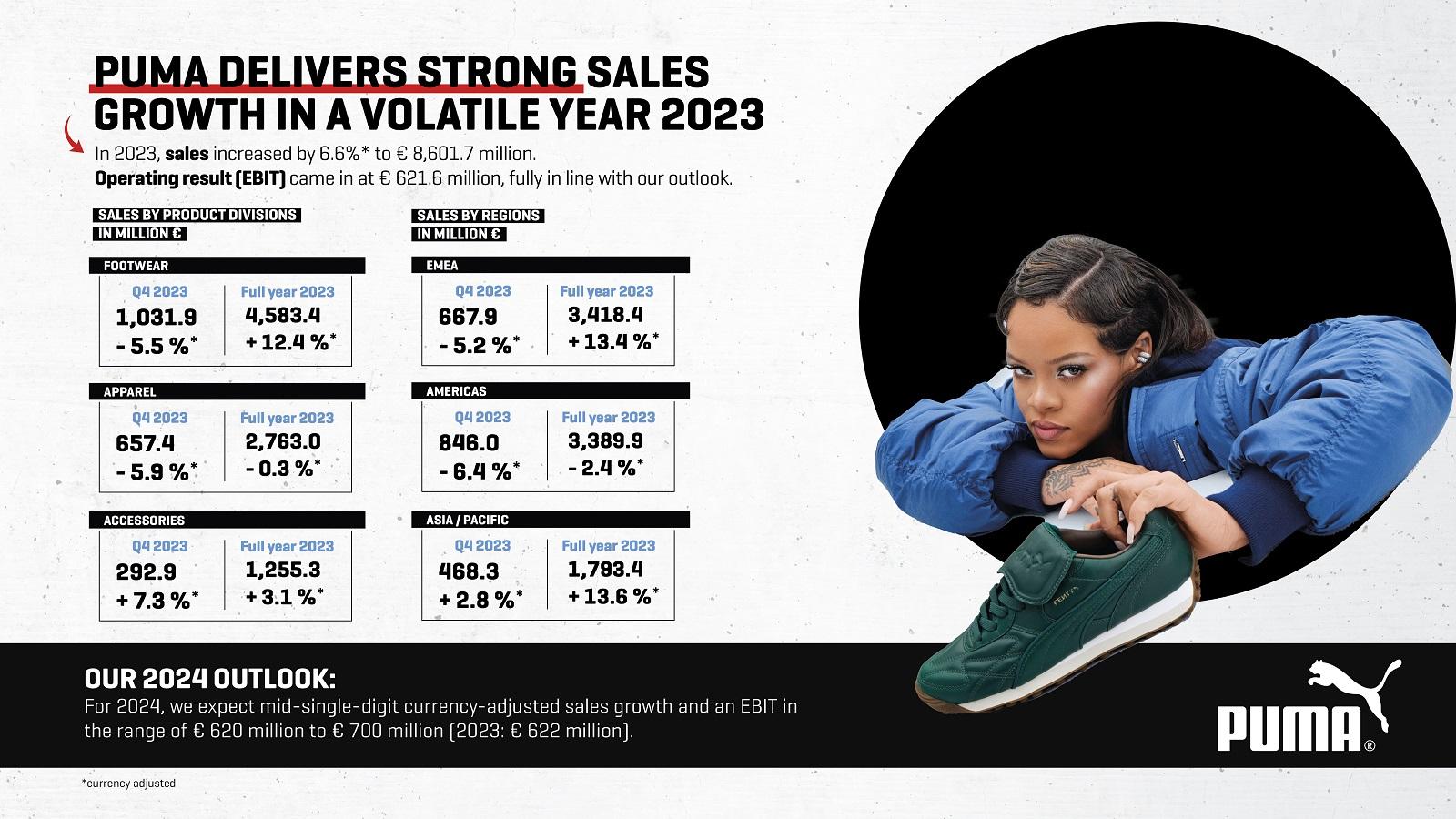

In the fourth quarter of 2023, Puma experienced a 6.4% decline in currency-adjusted sales in the Americas, amounting to 846 million euros. The devaluation of the Argentine peso contributed significantly to this downturn, reflecting the vulnerability to currency fluctuations.

Conversely, revenue in the Asia-Pacific region witnessed a positive trend, rising by 2.8% on a currency-adjusted basis to 468.3 million euros during the same quarter. This growth was primarily fueled by robust performance in the Greater China region and India.

Outlook and Projections

In a press release, Puma reiterated its 2024 projection of mid-single-digit percentage growth in currency-adjusted sales. The company also maintains its earnings target of 620 million to 700 million euros, underlining a strategic focus on sustainable financial performance.

Product Innovation and Strategy

Looking ahead into 2024, Puma envisions a year focused on innovation and product excellence. Introducing groundbreaking products like the Ultra football boot and Fast-R2 running shoes signifies a commitment to driving consumer engagement and brand loyalty.

Emphasizing its status as the "Fastest Sports Brand," Puma aims to strengthen its market position through a reinvigorated brand campaign in 2024. The strategic deployment of iconic products like the Mostro and Speedcat aligns with the brand's vision for sustained growth and market disruption.

In Sportstyle, Puma is set to unveil the Palermo and Suede XL models, catering to evolving consumer trends. The resurgence of classic designs like the Mostro and Speedcat underscores the brand's emphasis on innovation and heritage in product development.

Championing Innovation and Growth

As the "Challenger" in the market, Puma is poised to make 2024 a year of groundbreaking advancements and market leadership. With a renewed focus on "low profile" offerings and consumer engagement, the brand is primed to redefine industry standards and inspire a new wave of athletic excellence.

Photo: Puma Newsroom

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move

Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer

Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand

Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand  Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans

Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans  Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand

Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand