Japanese policy makers may worry about a falling core CPI and the risk of a technical recession in Q3.

"We believe any attempts to stimulate the economy would be more likely to revolve around fiscal policy than monetary policy. Unless the BoJ acknowledges the risk of a downshift in inflation expectations (unlikely at this stage), we believe it would be difficult to lay out the logic for further easing. At a time of stronger-than-expected tax revenues, it may be easier for the government to put together a stimulus package with a supplementary budget," added Barclays.

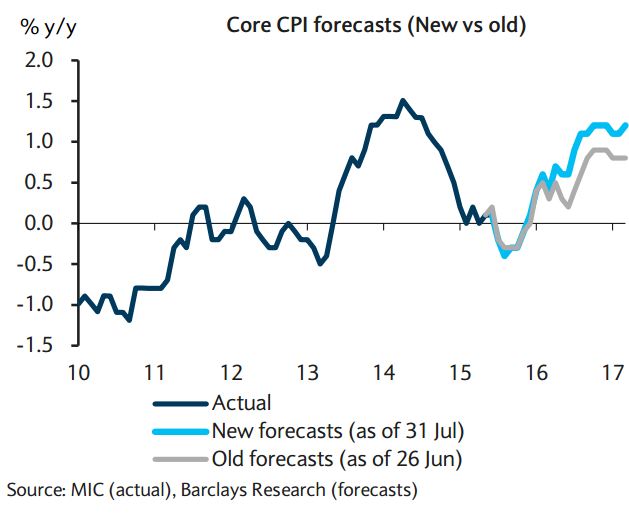

With the core CPI likely to fall y/y, the BoJ continues to stress the underlying trend, supporting inflation expectations. The stage does not appear set for further easing. However, the economy appeared to contract sharply in Q2.

"We expect it to recover in Q3, but ongoing weakness and higher revenues could lead to fiscal stimulus," noted Barclays.