Quotes from RBC Capital Markets

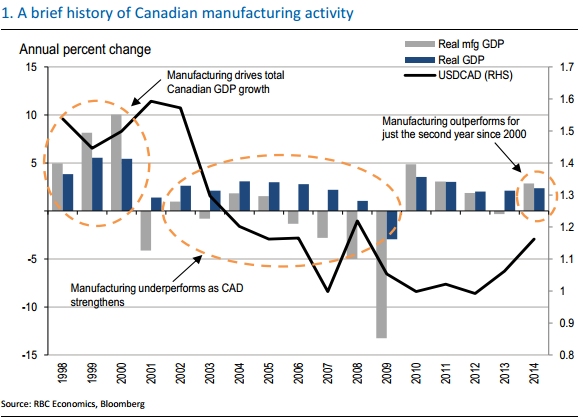

- The manufacturing sector is expected to be one of the biggest beneficiaries of lower oil prices and related depreciation in CAD.

- We expect that to be the case over the long run, but early warning signs suggest that the industry may actually be hurt by the sharp asset price moves initially.

- Our expected profile for USD/CAD reflects that, as we look for new highs toward 1.34 in the coming quarters before a gradual pullback into next year.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022