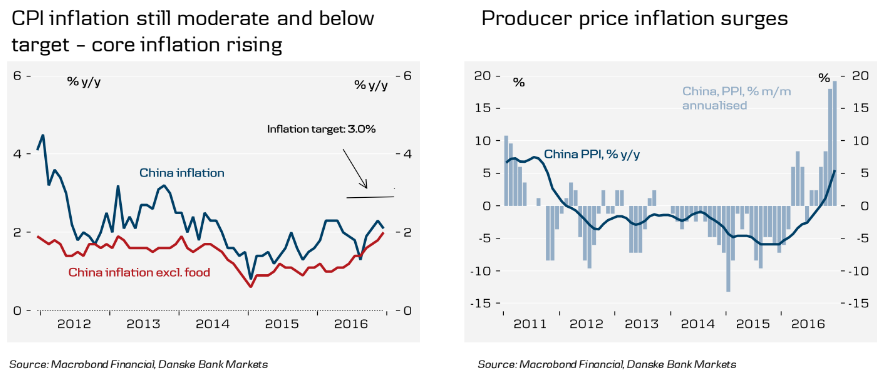

China Statistics Bureau report on January 10th showed China’s headline CPI inflation came in at 2.1 percent y/y in December, missing market expectations of 2.3 percent and below 2.3 percent recorded in November. On a monthly basis, CPI inflation rose 0.2 percent, up from 0.1 percent in the previous month.

However, China's producer prices rose for the fourth consecutive month in December to hit a 5-year high. China's producer prices rose in December at their fastest pace since September 2011 on strong raw material prices, signalling stabilization in the world's second largest economy. The producer price index gained 5.5 percent y/y compared with a 3.3 percent increase in November. The index increased 1.6 percent m/m in December, compared to 1.5 percent in November.

Rise in PPI inflation was fully in line with rise in commodity prices. Sharp rise in metal prices were observed over the past year, which accelerated post-Trump. Analysts expect PPI inflation to moderate again in 2017 as metal prices likely flatten out. That said, rise in PPI inflation is very supportive for profits. Higher producer prices improve profitability and thereby alleviate some of the liquidity pressure of corporates. That said, PPI inflation should moderate again in 2017 if metal prices flatten out.

Data suggests that "deflation is over", a trend analysts say could lead to less aggressive monetary policy. China normally hikes when CPI inflation rises which is not the case currently. Policy rates are likely to stay unchanged in the next 12-month horizon. The People's Bank of China (PBOC) is likely to hold a neutral position in its monetary policy as it pushes for structural reforms, such as tackling leverage in the property sector.

"The bottom line is that as long as the Chinese government is able to prevent deflation, (they can) buy time in order to fix some of the structural problems such as overcapacity, the economic outlook of China is not entirely pessimistic," said ANZ's chief economist for Greater China, Raymond Yeung.

Meanwhile, Shanghai Composite (SSEC) fell 0.30 percent to 3,161.67 and Shenzhen Composite (SZSE) Index slipped 0.25 percent to 10,306.34 by 07:15 GMT. FxWirePro's Hourly Yuan Strength Index remained neutral at 16.14 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits

Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits  Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound

Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary