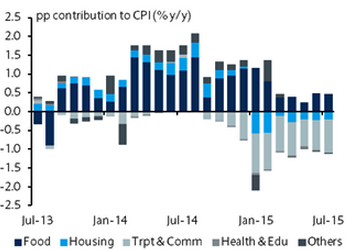

Taiwan inflation edged further into the negative territory at -0.66% y/y in July.

Overall, the path of inflation mainly reflected the renewed downward pressure on international oil prices, with the Brent falling by 12% on average in July. Meanwhile, the shock to food prices due to excess rainfall last month subsided, while the typhoon in early July seemed to have little impact on the food prices.

This led to oversupply in vegetables, with prices falling by 4.9% m/m in July. Core inflation edged up to 0.66% y/y in July (Jun and May: 0.59%), supported by higher entertainment prices.

"Still there is no deflationary risk seen, as core inflation will likely continue to be supported by solid domestic demand", says Barclays.

Indeed, the release of Q2 GDP showed no signs of any slowing in domestic consumption, with private consumption growing at a solid pace of 2.8% y/y in Q2 (Q1: 2.5%).

"As such, 2015 inflation is forecasted at -0.1% and inflation is expected to rebound to 2.1% in 2016, on account of a low base and subsequent pickup in oil prices", added Barclays.

Renewed pressure on oil pushes Taiwan inflation lower

Wednesday, August 5, 2015 7:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX