China’s bond market has been rattling in recent times, especially after the US election that has led to a surge in the dollar and US stocks as investors shun the safety of bonds. The recent strength of the dollar, which has pushed the yuan to the weakest level since June 2008 has led to concerns regarding liquidity problem in the debt market. The level of debt is extremely high in China, more than 250 percent of GDP. Though the majority of that debt is in local currency, a rise in the domestic interest rates would certainly lead to a rise in the debt servicing cost and prove detrimental to the economy.

In this article, we review China’s yield curve after US election.

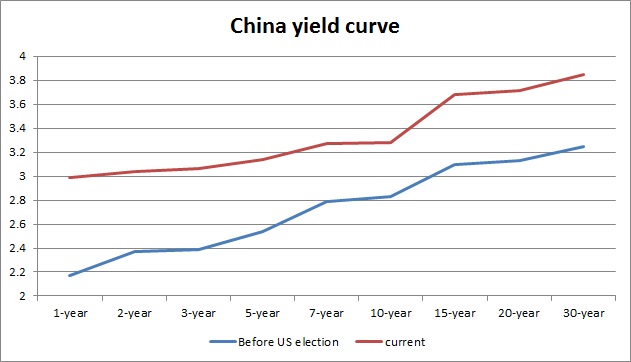

Figure 1 shows the yield curve as of now and just before the US election. The rise in the yield is quite sharp and it has been across the curve. Figure 2 shows the changes in yield across the curve for the same period. So, one can easily observe the following,

- The biggest of the rises have been in the shorter end of the curve, which is not at all a pricing of inflationary risks. Instead, the market is pricing short-term turmoil, such as a recession in the short run. 1-year yield rose by 82 basis points in this period.

- The curve has overall flattened.

- The very longer end of the curve has seen modest rising too, which could be a pricing for higher import prices after as the Yuan exchange rate collapsed against the dollar.

We suspect that China might be nearing debt bubble burst; hence it is vital to keep an eye on the short leg of the curve in the coming months.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record