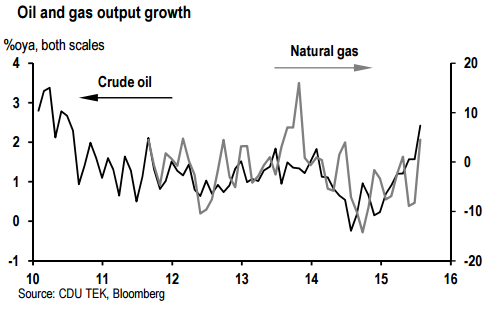

Russia's early July activity indicators suggest the economy may have gained some momentum into 3Q after a disappointing 2Q. Oil output growth firmed to 2.4%oya in July from 1.6% in June, accompanied by stronger refinery output. Natural gas output jumped 4.5%oya, after falling 8.2% the prior month, preliminary data show. Electricity consumption firmed to 1.1%oya from 0.7%, while railway transport turnover rose 2.3%, after falling 2.2% the prior month. A low base lifted year-ago comparisons this past July, but it seems that some underlying improvement was also behind stronger activity in mining and related sectors. That said, manufacturing may not be doing as well as mining, judging by the latest business surveys. The manufacturing PMI slipped to 48.3 in July from 48.7, although details were not as soft. Both the output and new orders indices edged 0.3pt higher, almost reaching the 50 threshold.

Inventories continued to decline, pushing up the forward-looking orders-to-inventory ratio further to 1.07. However, export orders fell again, dropping 2.5pt to 46.0, as did the employment index, which was down 0.2pt to 47.5. Another sign of softness in manufacturing is weak pricing power, as the output price index fell below the 50 threshold for the first time since April 2013, even as the ruble was sliding and the input price index edged up again in July, rising up 0.3 to 54.9. Rosstat's business survey also points to different paths for mining, where business confidence firmed a tick recently, and manufacturing, where confidence remained soft.

The services PMI surprised to the upside in July, with the activity index increasing to 51.6 from 49.5. The rise was especially surprising as the ruble continued to weaken last month, and it would be natural to expect the domestically-oriented services sector to follow suit. Yet, all key components of the survey rose last month, including orders, which was up 2.2pts, employment, up 1.3, and future business expectations, up 0.3pt, though they remained low versus their historical averages.

Russia's early July indicators point to a strong start to 3Q, at least in mining

Tuesday, August 11, 2015 2:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed