Primary goal of Swiss National Bank's (SNB) monetary policy is to maintain price stability, however evidence indicate that SNB is failing its goal for consecutive years putting serious doubts on SNB's credibility as well as ability to move inflation to the positive side.

- Consumer price index dropped by -0.2% m/m in April and down by -1.1% on yearly basis.

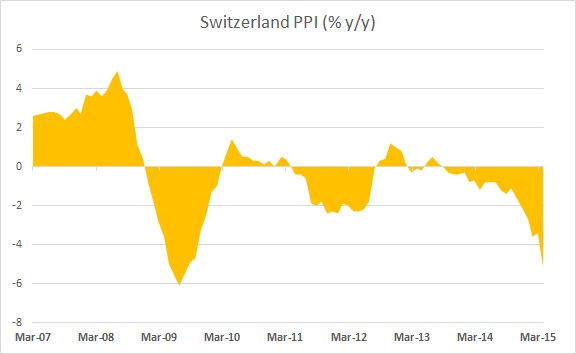

- Today's producer price index release saw deflationary pressure accelerating. For April PPI dropped by -2.1% m/m and -5.2% on yearly basis. This is worst reading since 2008 crisis.

SNB has lost credibility to market participants by removing Euro-Franc 1.20 floor on January 15th, just three days after vowing to maintain it. Franc appreciated almost 40% against Euro at one point post decision, which led to bankruptcies for some forex brokers.

- Swiss purchasing managers' index has moved to contractionary zone since that decision indicating it has hurt Swiss companies.

Switzerland has so far been able to maintain its large trade balance, however with stronger Franc and deepening deflation there remains doubt on sustainability.

SNB - out of tools?

- SNB has deployed negative libor range 0f -1.25-0.25, negative rates of -0.75% on sight deposits and amassed CHF 521 billion worth of balance sheet assets.

SNB might be running low on options with all of its measure failing to stroke inflation. Franc is one of the few currency to have appreciated against dollar since mid-2014. Franc is trading at 0.917 against dollar and would keep performing stronger against major counterparts, unless SNB takes further action.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary