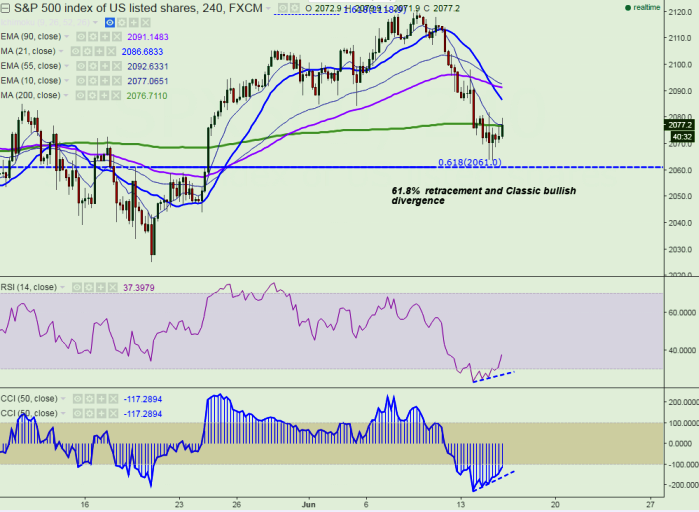

- Pattern formed – classic bullish divergence

- Potential Reversal Zone- 2060

- S&P500 has recovered after making a low of 2063.70.it is currently trading around 2078. Short term trend is lightly bullish as long as support 2060 holds.

- Any indicative break below 2060 will drag the index down till 2052 (90 day EMA)/2044.

- S&P500 index resistance is around 2077 (200 4H MA) and any break above targets 2088/2093/2108.50.

It is good to buy at dips around 2072-75 with SL around 2060 for the TP of 2098/2108