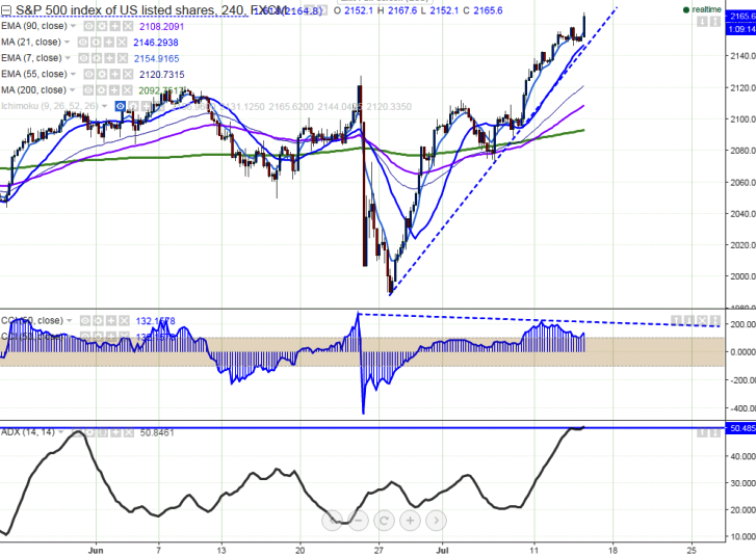

- Major resistance – 2165 (161.8% retracement of 2114 and 2025)

- Pattern formed – CCI (50)

bearish divergence

- S&P500 has made a high of 2163.5 at the time of writing and is currently trading around 2162.5.

- The index has declined till 2146 yesterday and slightly jumped from that level. S&P500 is in over bought zone a slight dip till 2145/2123 (4 hour Kijun-Sen).

- On the higher side, any break above 2165 will take the index till 2180/2200.

It is sell on rallies around 2165-2168 with 2180 for the TP of 2145/2125.