Bitcoin (BTCUSD) is consolidating after hitting a fresh all-time high of $93,483. It is currently trading around $91,298.

2. Michael Saylor's Bullish Prediction for Bitcoin

Michael Saylor, co-founder of MicroStrategy, recently made headlines by predicting that Bitcoin could reach $100,000 by the end of this year. His forecast comes amid growing optimism in the cryptocurrency market, supported by remarks from other notable figures like Tom Lee. Saylor believes that increased institutional adoption and a favorable regulatory environment will drive Bitcoin's price higher. He also points out that as more companies start using Bitcoin as part of their financial strategies, demand will grow, leading to higher prices. Additionally, the upcoming Bitcoin halving event in April 2024 is expected to contribute to price increases, based on past trends.

3. Significant Inflows in Bitcoin ETFs

As of November 15, 2024, the U.S. Bitcoin ETF market saw a significant increase, with net inflows of about $1.81 billion for the week. This boost in investment is linked to positive feelings in the market following Donald Trump's election victory and hopes for better regulatory conditions for cryptocurrencies. A major contributor to this surge was BlackRock's iShares Bitcoin Trust (IBIT), which alone brought in over $2 billion in just one week.

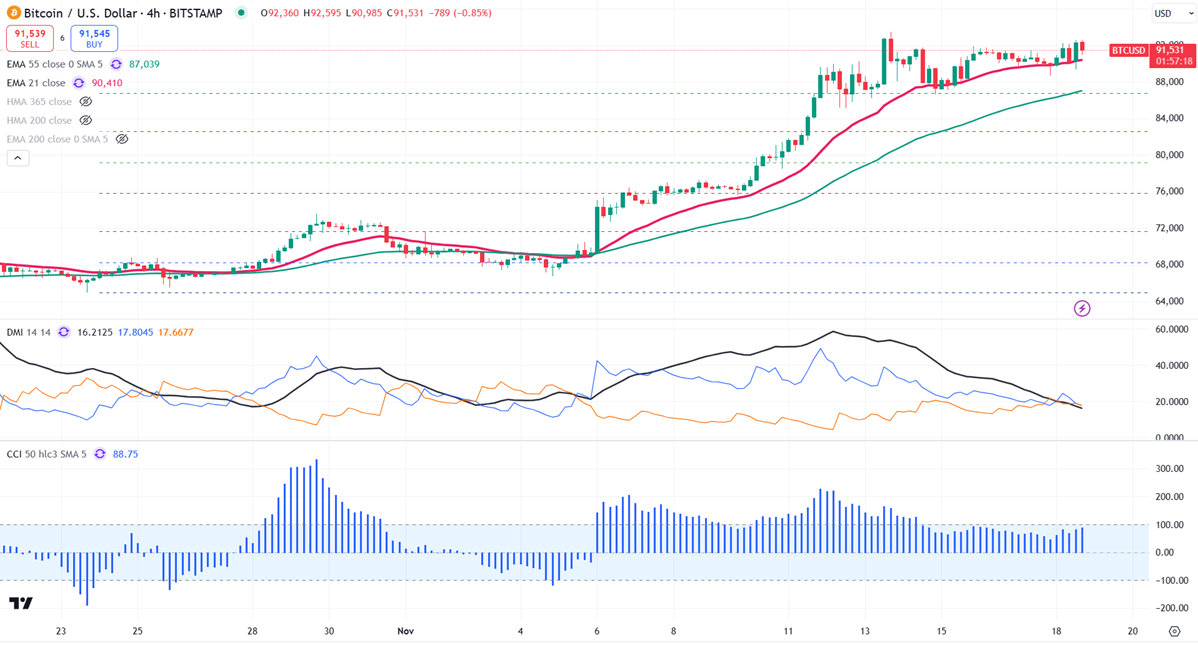

4. Technical Analysis and Price Levels

BTCUSD trades above the short-term moving averages (34-EMA and 55-EMA) and the long-term moving average (200-EMA) in the daily chart. Minor support is at $86,700; any break below this will target $84,000, $80,000, or $75,800.

5. Bullish Scenarios and Investment Strategy

In the bullish case, the primary supply zone is at $95,000. A break above this level confirms intraday bullishness, with a potential jump to $100,000. A secondary barrier at $100,000 suggests that a close above this level could target $110,000. Indicators on the 4-hour chart, including a bullish Commodity Channel Index (CCI) and Average Directional Movement Index, support this outlook. It may be good to buy on dips around $80,000, with a stop-loss around $76,000 for a target price of $100,000.

BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket

BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket  ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500

ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now

Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever