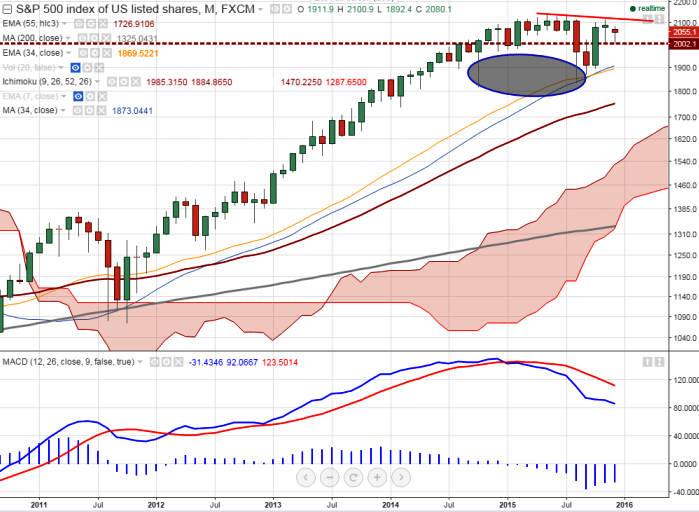

- Major resistance (Long term) - 2115

(trend line joining 2137 and 2132)

- Minor support (Short term) - 1990

- The index has made a low of 1993 and started to recover from that level. It is currently trading around 2055.

- S&P500 is expected to trade weak in 2016 as long as resistance 2108 holds. Any slight bullishness can be seen only if it above 2115. Close above 2115 will take the pair till 2192 (161.8% retracement of 2116 and 1993)/2253/2324 (161.8% retracement of 2137 and 1833).

- On the downside any break below 1990 will take the pair to next level till 1940/1900.

- Any break below 1900 will take the index further down till 1833/1800. Long term weakness can be seen only below 1800 level.

It is good to sell on rallies around 2060-70 with SL around 2120 for the TP of 1990/1900/1835