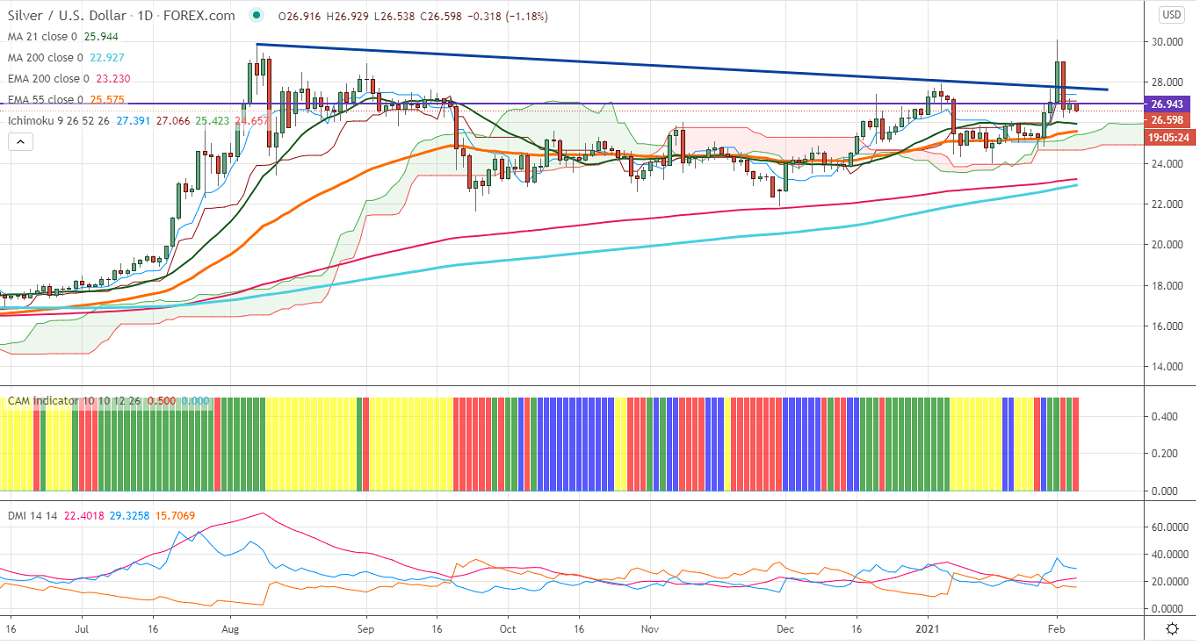

Ichimoku analysis (Daily chart)

Tenken-Sen- $27.39

Kijun-Sen- $27.06

Silver was the best performer for the past three weeks and gained more than 25%. The surge in global demand and weakness in the US dollar has pushed Silver prices to an eight-year high. The precious metal declined more than $3.5 on massive recovery in the US dollar. DXY is holding above 91 levels, jump above 91.30 confirms bullish continuation. The overall trend is bullish as long as support $26 holds.

Technically, silver's significant support is at $26 and violation below will drag the pair down to $25.48/$25/$24.05. The near term resistance is at $27.20, any surge past targets $28/$28.62/$29 is possible.

It is good to sell on rallies around $26.95-27 with SL around $27.20 for TP of $24.05