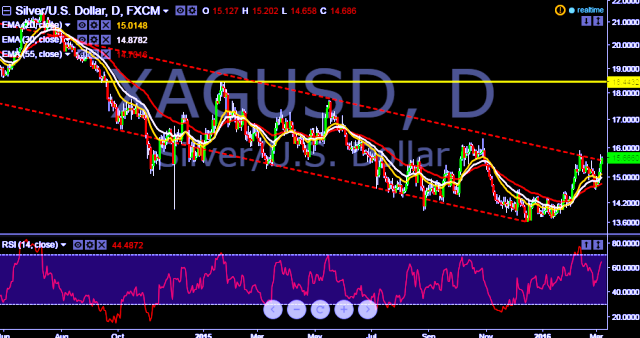

- Pair is currently trading at $15.66 levels.

- It made intraday high at $15.69 and low at $15.44 levels.

- Intraday bias remains bullish for the moment.

- On the top side, key resistance falls at $15.92.

- A daily close above $15.92 will drag the parity towards multiyear high around $17.75.

- Alternatively, reversal from key resistance will take the parity back below $15.00 marks.

We prefer to take long position in XAG/USD around $15.60, stop loss $15.45 and target $15.82/$15.92 levels.