The advance estimate for Q2 GDP showed a deeper contraction of 4.6% q/q saar, well below consensus expectations (-1.5% q/q saar). The softness was driven by a 14% q/q saar decline in manufacturing output. The soft print reflects the sudden stop in US growth momentum in Q1, which was distorted heavily by bad weather and the West Coast port strike - which disrupted supply chains and the flow of US bound shipments from Asia until late Q2.

Barclays notes:

- Anticipating a similarly weak final Q2 GDP outturn, we lower our 2015 and 2016 full-year growth forecasts by 1.4pp and 0.5pp to 2.0% and 2.5%, respectively.

- That said, we do not expect a further sequential growth contraction in Singapore in Q3, given that US growth regained momentum in Q2.

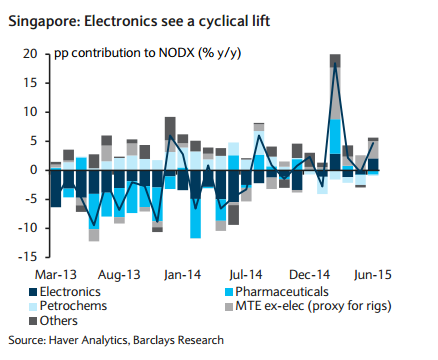

- We also expect some cyclical recovery in manufacturing, particularly in electronics.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed