Industrial output in Singapore delivered a solid performance during the month of March, as electronics continued to remain in the driving seat.

Headline industrial output for the month expanded by 10.2 percent y/y. This is another strong showing following a revised 10.2 percent run in the previous month. On the margin, production level was up by 5.0 percent m/m (s.a.), after two consecutive months of decline. The strong run in manufacturing appears unabated and any concern regarding its sustainability will be kept under the carpet for the time being.

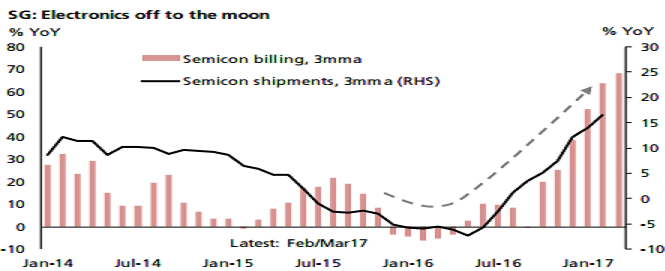

Production output was up by 37.7 percent y/y as indicators on global electronics cycle are reflecting an upswing in electronics demand. Both billings for semiconductor equipment and shipments of semiconductors are heading to the moon. However, the strong run in electronics is largely driven by consumer demand at present. Much will depend on companies increasing their capex in the coming months, which then provide the cluster with a second wind.

The main takeaway from the most recent set of IP figures is that 1Q GDP growth figures of 2.5 percent y/y will be revised upward. The Q1 2017 advance GDP estimates assumed a manufacturing growth of 6.6 percent y/y in the quarter. As it is, the sector has now expanded by 8.1 percent. This alone will add another 0.3 percentage point to the earlier GDP growth projection, which will be closer to our forecast of 2.9 percent.

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks