The stock of SoftBank Group Corp. experienced a notable rise as founder Masayoshi Son explores the establishment of a groundbreaking $100 billion chip venture aimed at supplying AI-enabling semiconductors.

Izanagi Chip Venture

Shares in the Tokyo-based technology investor saw an increase of up to 3.2% following reports from Bloomberg News indicating the 66-year-old billionaire's pursuit of funding for an AI chip venture, codenamed Izanagi.

This venture is designed to compete with industry leader Nvidia Corp. It would serve as a strategic complement to Arm Holdings Plc, the chip design company in which SoftBank holds a majority stake.

Bloomberg reported that the initiative seeks to establish a formidable presence in the AI chip sector and aims to address the growing demand for essential semiconductors for AI applications, citing inside sources.

Aiming to Build an AI Chip Powerhouse

The project, Izanagi, signifies a significant leap into the AI realm for Son, particularly as SoftBank refocuses its investments away from start-ups.

Son envisions the creation of a company that synergizes with Arm Holdings Plc's chip design capabilities to build a robust AI chip powerhouse.

SoftBank, a Japanese conglomerate, currently holds approximately 90 percent of the shares in the British chip designer Arm, as the London Stock Exchange Group (LSEG) reported.

According to Bloomberg, Izanagi's proposed total funding structure amounts to $100 billion, with $30 billion originating from SoftBank and an additional $70 billion potentially sourced from Middle Eastern institutions.

Implications of Success: A Major AI Investment

If realized, the Izanagi chip project could emerge as one of the most significant investments in the AI sector in recent years, potentially surpassing Microsoft Corporation's notable $10 billion investment in OpenAI.

According to Live Mint, Son's choice of the name Izanagi, inspired by the Japanese god of creation and life, reflects his vision for artificial general intelligence (AGI) as he remains steadfast in his belief that AGI will become a reality within the next decade, the report noted.

Yoshimitsu Goto, SoftBank's Chief Financial Officer, emphasized Arm's pivotal role in the AI landscape, describing the chip designer as "the core of the core" within SoftBank's group of companies.

Executives at Arm have reported robust demand for their central processors, particularly in conjunction with Nvidia's chips for AI tasks in data centers.

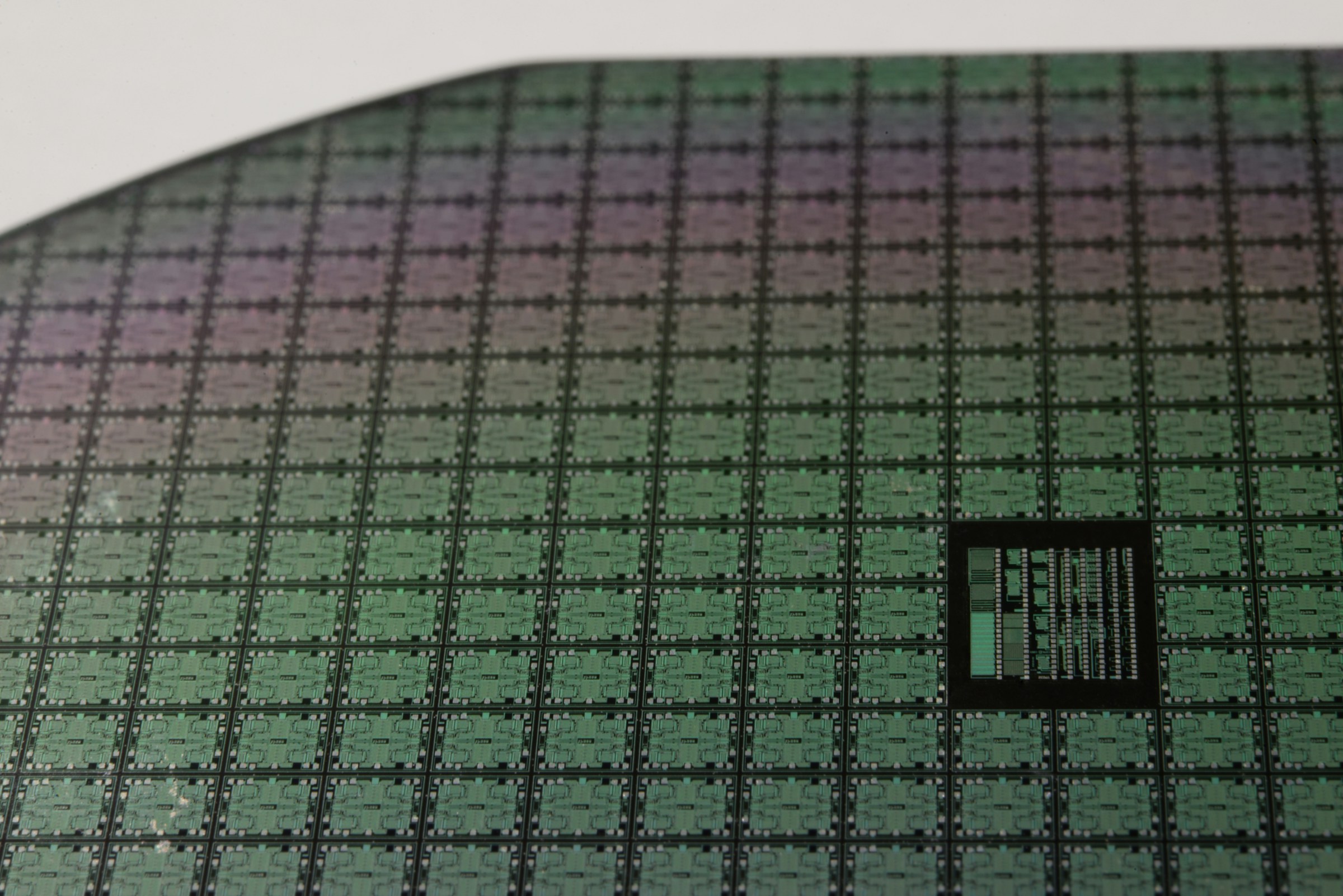

Photo: Laura Ockel/Unsplash

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary