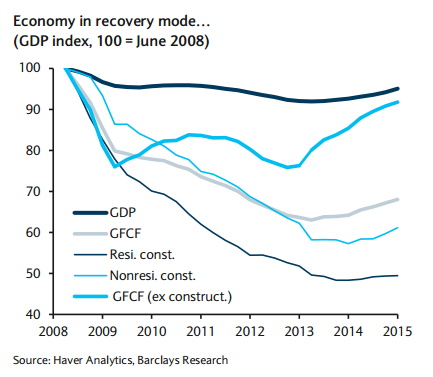

Economic activity continues to beat most market expectations. The Spanish economy grew by 0.9% q/q in Q1 15. As in other EA economies, private consumption was the main driver, even if private sector investment and public consumption grew at a meaningful pace. Imports of capital and consumption goods also strengthened as general activity improved, driving the net export growth contribution down to just 0.1pp, in contrast to 0.8pp for domestic demand.

Most Q2 data are consistent with a slight acceleration in Q2 GDP to about 1.1% q/q. Private consumption continues to be a key driver: PMIs, retail sales and, more important, improving labour market conditions, also signal vigorous consumption growth of 0.8% q/q. The most recent labour data on social security affiliations and registered unemployment are consistent with higher growth in Q2 relative to Q1. Wages are also increasing. In Q2, company and trade union representatives signed a new agreement for wages (for all sectors) to increase by up to 1% this year and by up to 1.5% in 2016.

The outlook for H2 15 and 2016 remains positive, even if the quarterly growth profile is likely to decelerate slightly relative to H1 15. The deceleration is set to be felt mainly by end-2015 and in early 2016 as uncertainty about the general election is likely to curb both private consumption and investment (more on political risks' below).

"In 2016, we expect improving disposable income and financing conditions, as well as further recovery in the labour market. We also expect net exports to contribute positively as key trading partners experience slightly better growth prospects, sustaining and possibly slightly improving the market share of Spanish exports. All in all, we expect relatively strong growth of 2.7% in 2016," says Barclays.

On the fiscal outlook, in 2015 the cyclically adjusted fiscal balance will be slightly accommodative. The consolidated budget balance through April (excluding municipalities) has been reduced by 10.7% y/y: the deficit reached 1.05% of GDP versus 1.2% in April 2014.

"We see some downside risk to the deficit target of 4.2% of GDP, mainly related to the electoral cycle. Public expenditure was higher than expected in Q1 15, probably driven by the regional and municipal elections in May. We expect similar slippages on public expenditure in H2 15," added Barclays.

Moreover, the government has announced cuts to the personal income tax rate, applicable in July 2015 and worth EUR1.5bn. Overall, the extent of fiscal slippage this year will be large (less than 0.5%), mainly because strong growth is compensating somewhat, but a tighter fiscal stance will be needed in 2016 to meet the government's medium-term fiscal targets and debt-reduction objectives. The deficit target for 2016 is 2.7% of GDP and the government expects public debt to fall slightly in 2016, after peaking this year at nearly 99% of GDP.

Spanish economic growth beating expectations

Wednesday, July 22, 2015 11:49 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022