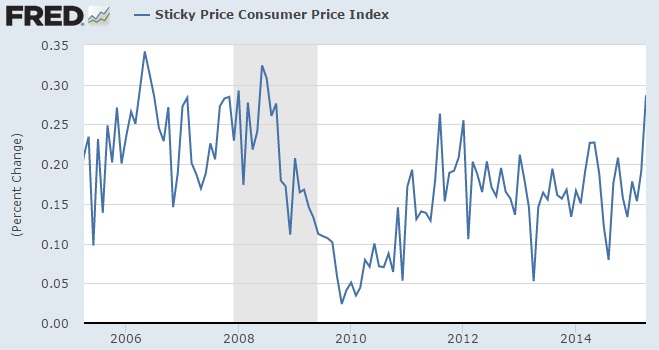

The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis.

Federal Reserve Atlanta publishes sticky price CPI that tracks changes in these particular goods and services.

- In April 2015, Sticky price consumer price index rose to highest level since 2008 crisis to 0.286% percent. Annualized sticky price CPI rose to 3.5%in April.

Some components of CPI indicates that FED might be closer to rate hike than market participants are predicting.

Current Federal funds rate future is indicating first rate hike very late this year around December or very early next year about January. However inflation and Janet Yellen's speech on Friday indicated that it might come as early as September, if not June.

With downtrend break, expect dollar to do well in the coming days. Dollar index is currently trading at 96.33, up 0.20%.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary