For the first time since the November 3 election, Donald Trump has hinted that he will allow a smooth transition of power to Joe Biden. Although in a series of tweets, he described the election as “corrupt” and pledged to “keep up the good fight”. Despite this, General Services Administration chief Emily Murphy told President-elect Joe Biden that federal resources were now available to ease his transition.

Following the news, futures on the Dow Jones Industrial Average gained 260 points, alongside both S&P 500 and Nasdaq 100 futures also trending higher. This is a sign that markets are responding positively to a Biden presidency and a move away from Trump’s industry and "America first" approach.

Trump’s Successful “America First” Approach

Prior to the election, President Trump’s “America first” ethos put the economy in a strong position. During his presidency, he proposed the elimination of estate taxes and a corporation rate tax cut from 35% to 20%. He also reduced federal tax brackets for individuals from seven to three. As part of his “America first” ethos, he was even engaged in the infamous China/US 'trade war' in early 2020. These economic policies worked: the S&P 500 generated returns of +50% at the end of 2019, and unemployment dipped below 4% at the start of 2020.

Prior to the election, some analysts believed the S&P 500 could be used to predict Trump as the winner. This is because the S&P 500 index had successfully predicted 87% of elections previously. Historically, the index usually shows that, if stocks are higher three months before an election, the incumbent party will win. However, a Biden win signified a change in approach, and many were unsure how the markets would react to a president who was less pro-industry.

Markets Continue to React Positively to a Biden Administration

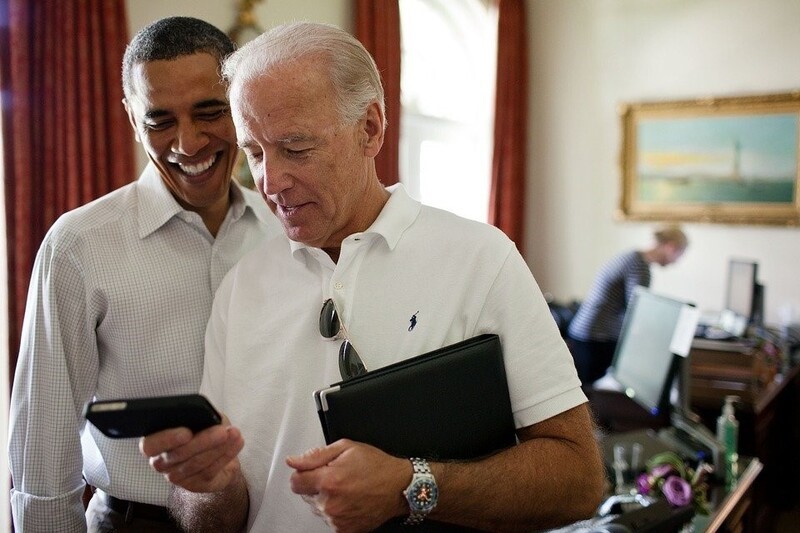

Source: Pixabay

Trump was viewed as a president who was focused on the succession of the economy and US stock market. But news of a Biden presidency was warmly received on Wall Street, and stock markets soared on election day as traders anticipated a Democratic victory. Following the official calling of the race on November 7, stock markets from all over the world reacted positively. The FTSE 100 crossed the 6,000 barrier, and the Nikkei 225 reached its highest level since 1991.

In addition, the news that a smooth transfer of power ma soon begin caused the S&P 500 index to rise by 0.8%. On top of this, rumours that President-elect Biden will announce Janet Yellen as his Treasury Secretary caused major averages to hit session highs. During her time at the Federal Reserve, Yellen oversaw substantial changes. These included a long period of economic expansion and historically-low interest rates. As a result, she’s seen as a market-friendly pick. It’s also seen as a symbol that President Biden will focus on rebuilding the American economy rather than pursuing a comparatively aggressive regulatory policy.

Looking to the future, as the transfer of power commences, it will be interesting to see how the markets react to a Biden presidency. During the Trump years, wild policy swings saw markets fluctuate. However, President Trump’s pro-business policies were also welcomed on Wall Street. A Biden presidency promises to be much more stable and reserved. However, as President Biden injects money into the economy, and starts his clean energy initiatives, expect the markets to react positively. But should he introduce his promised 39.6% marginal tax rise on high earners, we may see some market backlash.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit