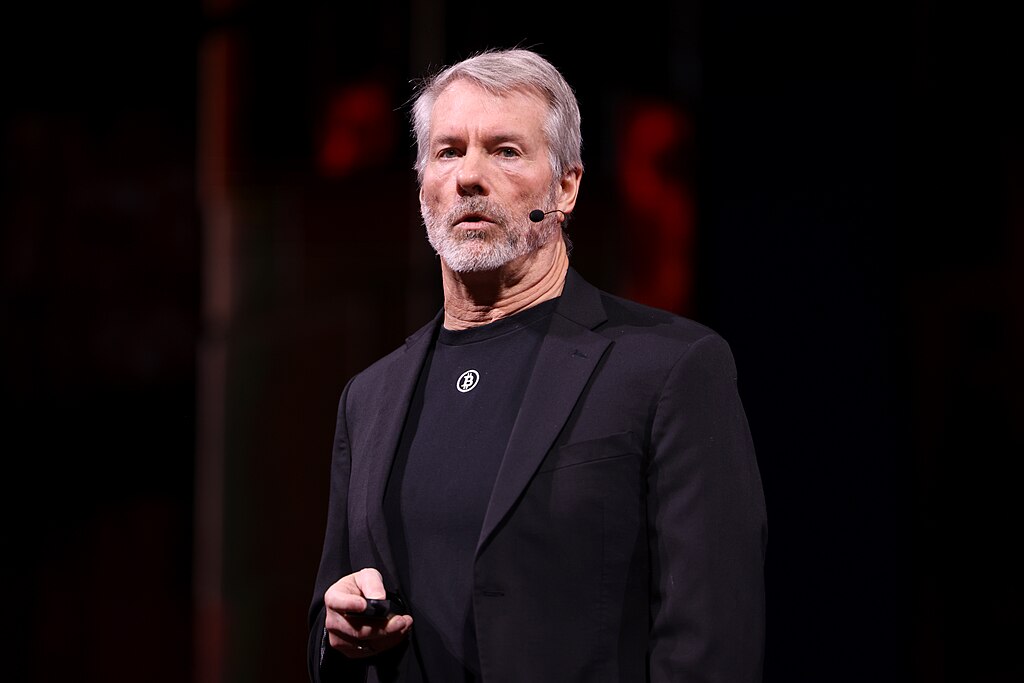

Bitcoin-focused firm Strategy has successfully maintained its position in the Nasdaq 100, extending its stay in the influential index as debates intensify over the sustainability of crypto treasury companies. The decision comes as analysts and index providers increasingly question whether companies centered on buying and holding bitcoin still fit the profile of traditional operating businesses.

Formerly known as MicroStrategy, Strategy began as an enterprise software company before pivoting in 2020 to a bitcoin-heavy balance sheet strategy. Since then, it has become the world’s largest corporate holder of bitcoin, a move that has inspired dozens of similar firms globally. Strategy was added to the Nasdaq 100 in December last year under the technology classification, reflecting its historical roots rather than its current business focus.

However, market observers argue that Strategy’s business model now resembles that of an investment fund more than a technology company. Its stock price has shown extreme sensitivity to bitcoin price fluctuations, amplifying concerns about volatility and long-term viability. These concerns extend beyond Nasdaq, with global index provider MSCI also reviewing whether digital-asset treasury companies should remain in its benchmarks. MSCI is expected to announce a decision in January that could potentially exclude Strategy and comparable firms.

In its latest annual rebalancing, Nasdaq announced the removal of Biogen, CDW Corporation, GlobalFoundries, Lululemon Athletica, On Semiconductor, and Trade Desk from the Nasdaq 100. New additions to the index include Alnylam Pharmaceuticals, Ferrovial, Insmed, Monolithic Power Systems, Seagate Technology, and Western Digital. Despite these changes, Strategy retained its position, underscoring its sizable market capitalization and continued relevance to investors.

The updated Nasdaq 100 composition is scheduled to take effect on December 22. The index tracks the largest non-financial companies listed on the Nasdaq exchange by market value and is widely followed by institutional and retail investors.

As regulatory scrutiny and index methodology reviews continue, Strategy’s future inclusion in major benchmarks may hinge on how index providers define operating companies in an era where digital assets play an increasingly central role.

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates