Canadian dollar is currently trading at 1.219 against dollar, advance was halted at 1.225-1.227, immediate resistance area. Canadian dollar has been taking cues from broad based dollar strength and oil price.

After advancing against dollar with rise in oil price, USD/CAD found support near 1.19. Several support area lies underneath and it will not be easy for Loonie to break below. Canadian dollar is likely to trade in consolidation against dollar for now.

Today's CPI numbers might provide strength required to Loonie.

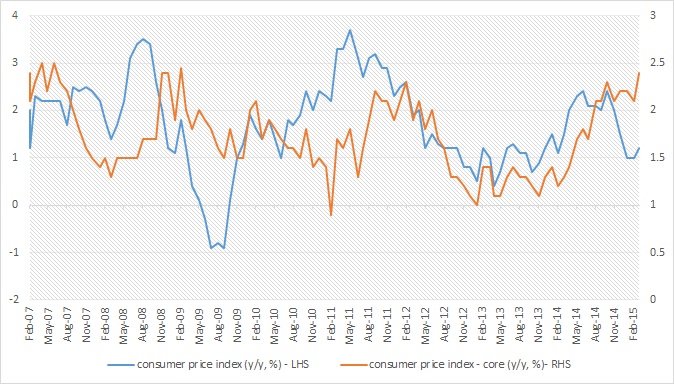

Past trends -

- Headline consumer inflation has fallen from above 2% to 1% over the last year. However this is mostly due to lower energy prices. However with oil price somewhat bouncing back, headline inflation has given an uptick for first time since mid-last year. In March, headline inflation was 1.2%.

- However core inflation has remained steady in spite of recent drop in energy prices and rising steadily from 1% in 2013 to 2.4% as of March, 2015. Core inflation rate now stands very close to pre-crisis level of 3%.

If inflation moves up today, both core and headline, Bank of Canada (BOC) policymakers will be watchful and likely to hold policy steady.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary