Today German IFO assessments are to be released around 8:00 GMT.

Past trends -

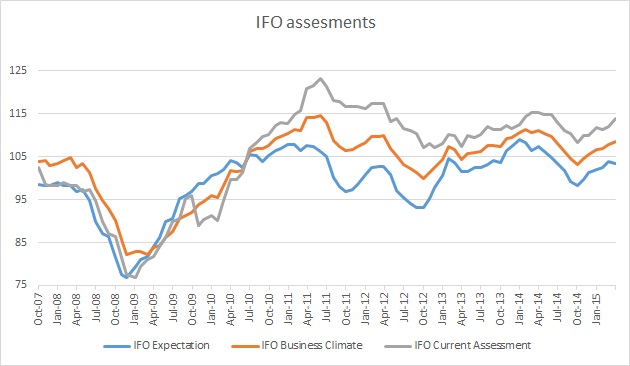

- Germany's resilience during 2008 crisis have pushed IFO assessments (Expectations. Business Climate and Current assessment) have pushed through pre-crisis high. In 2011 assessments reached to highest peak however deteriorated over Euro zone Debt crisis.

- After recovery in 2013, assessments dropped once again in 2014, underpinning slowdown in recovery. However that has changed sharply since European Central Bank announced its asset purchase program.

- In April, IFO expectation index touched 103.5, up from 99.3 in September, 2014. IFO business climate touched 108.6, up from 103.2 in November, 2014. IFO current assessment touched 113.9, up from 108.4 in October, 2014.

Expectation today -

- Little softer reading is expected from all of them, expecting -0.3 tick down in all.

Impact -

- Stronger IFO assessments would indicate further good days ahead. However current ongoing Greek Drama might push the index lower than expected.

Expect stronger performance from German stock index DAX if IFO surprises on upside. German bund 1yields might rise higher if IFO improves further.

Euro is currently trading at 1.114 will most likely shrug off the data as US CPI looms large later today.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?