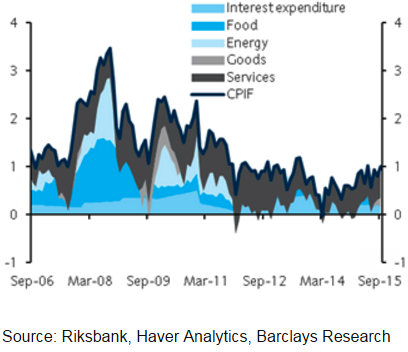

Swedish inflation and inflation expectations are on an uptrend, but inflation forecasts have been revised slightly lower in the October MPR, acknowledging global disinflationary pressures.

The Riksbank acknowledged that its expansionary monetary policy is having a meaningful effect on stabilising medium-term inflation expectations and contributing to a stronger Swedish economy, a fall in unemployment and a clear upward trend in spot inflation.

"However, inflation abroad will likely be lower than previously expected, pushing major central banks to pursue further easing for a prolonged period of time. Due to renewed global disinflationary pressures, the Riksbank no longer expects CPIF inflation to hit 2% in 2016, which is now expected to occur in Q1 2017", says Barclays.

In terms of GDP, the Riksbank continues to project a solid pace of growth and has revised 2015 GDP forecasts higher to 3.3% from 3.1% in the September MPR. The 2016 forecasts have been revised lower to 3%, however, as some of the recent economic activity moderates. The economy is still expected to grow at a solid 2.7% in 2017.

Sweden inflation on uptrend

Thursday, October 29, 2015 3:09 AM UTC

Editor's Picks

- Market Data

Most Popular