Swedish activity and confidence data releases in the coming week are expected to steer the path for the SEK, likely confirming a positive economic outlook. Solid retail sales (Tuesday) and the preliminary release of Q2 GDP (Thursday) should help unwind some of the recent currency weakness following the surprise Riksbank cut, which has driven EURSEK close to the top end of its recent multi-month range.

Barclays notes:

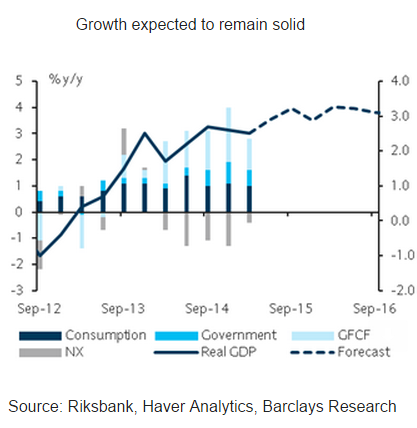

The release of the Economic Tendency Report (Wednesday) will provide further insights into the country's economic outlook and we expect the ETS Index to resume its uptrend. In line with the market (2.6% y/y) and the Riksbank's (2.8% y/y) expectations, we expect a solid rebound in Q2 economic activity despite the recent weaker-than-expected data reflected in our DSI. We think the trend of weaker data is likely to only prove temporary.

Further ahead, we continue to expect a modest pick-up in inflation and further improvements in the Swedish labour market, likely allowing the Riksbank to tolerate moderate currency strength. We remain short EURSEK on the basis of the superior growth prospects in Sweden, a very undervalued SEK and our expectations that the Riksbank is close to the bottom of its easing cycle and see the recent uptick in EURSEK as an opportunity to re-engage in short positions.

Swedish activity data to test recent SEK weakness

Sunday, July 26, 2015 9:26 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX