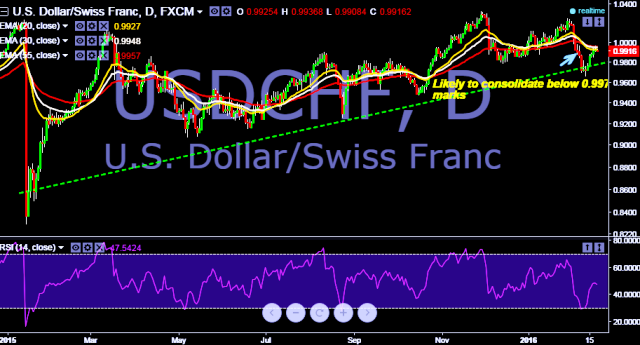

- Pair is currently trading at 0.9917 levels.

- It made intraday high at 0.9936 and low at 0.9908 levels.

- Intraday bias remains bearish below the 1.0073 levels.

- 10, 25 and 50D EMA heads down, which signals bearish trend.

- Upside of recovery should be limited below 0.9972 resistance levels and bring another fall.

- A daily close above 0.9972 levels will turn near term outlook bullish.

- Alternatively, correction from 0.9968 levels will take the parity towards 0.9662 and 0.9475 thereafter.

We prefer to take short position is USD/CHF around 0.9935, stop loss 1.0073 and target 0.9784/0.9662 levels.