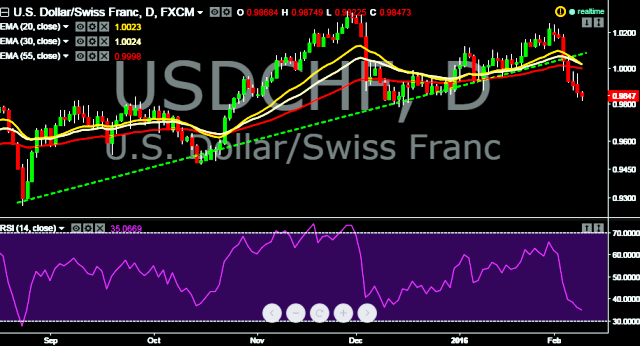

- Pair is currently trading around 0.9854 levels.

- It made intraday high at 0.9874 levels and low around 0.9822 levels.

- Intraday bias remains bearish below 1.0078 levels.

- Above 1.0078 minor resistance levels will turn bias back to the upside.

- Meanwhile, a daily close below 0.9784 support levels will take the parity towards major support levels at 0.9475 low.

- Initial resistance levels are seen at 0.9894, 1.0078 and 1.0256 levels.

- Major support levels are seen around 0.9815, 0.9784 and 0.9683 levels.

We prefer to take short position in USD/CHF around 0.9850 levels, stop loss at 1.0078 and target at 0.9784 levels.