USD-TRY has declined by a solid 1% since reaching a high of near 2.80 earlier this week. This seems as a reflection of 1) the sharp pullback in G10 yields this week, and 2) falling oil and commodity prices, which help Turkey's current account balance. In this context, yesterday's June current account data showed continued year-on-year improvement - a $3.4bn deficit in June 2015 vs. $4.2bn a year ago.

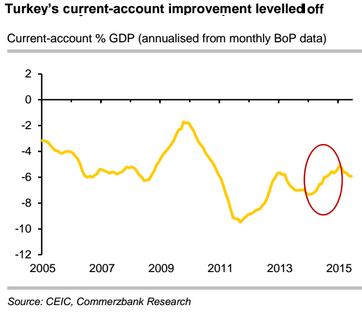

In recent months that the pace of improvement has now levelled off, and the current account to GDP ratio stabilising in the 5.5%-6.0% range on an annualised rolling basis, notes Commerzbank. Exports were down 6.7% yoy in June, and preliminary industry association data suggest that July will be weaker - so there is no improvement on the export front. But, on a positive note, the June data did not reflect the latest drop in the crude oil price to below $50/bbl.

"Turkey's current-account deficit did narrow noticeably in 2014 when the oil price fell by a large magnitude; this month's oil price drop is not comparable of course, but Turkey is likely to benefit at least modestly: therefore, current account deficit would be 4.4% of GDP for 2015. With the help of tighter rates from CBT before year-end, USD-TRY is likely to stabilise in the 2.75 region through year-end", estimates Commerzbank.

TRY gains as G10 yields, commodity prices retreat

Wednesday, August 12, 2015 7:13 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022