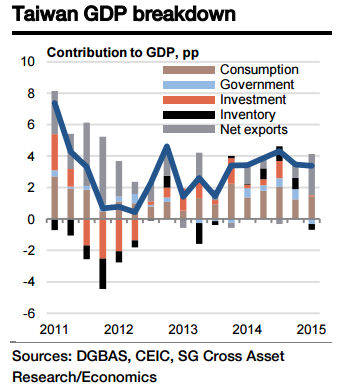

After an exceptional contribution to GDP growth in Q1 (+2.6pp), Taiwan's net exports are likely to have declined in Q2 and dragged growth down sharply by 3.5pp. Owning to soft demand for electronics, real merchandise export growth fell acutely to -2.3% yoy in Q2 from 4.5% yoy in Q1. Slowing visitor growth also points to a drop in service exports over the same period.

Meanwhile, real merchandise imports decelerated mildly to 1% yoy in Q2 from 2.7% yoy with a rebound in real capital goods offsetting part of the weakness. Service imports probably held up well too, as the number of outbound travellers continued to grow fast, in particular those visiting Japan as a result of the weaker yen. Therefore, net exports probably shrunk significantly in Q2 and became the biggest drag on growth. That said, this account is very volatile, and a recovery in global demand in H2 bodes well for a rebound in exports.

Domestic demand is expected to have strengthened, adding 0.8pp to growth. Private consumption growth probably ticked down to 2.4% yoy in Q2 after printing at 2.5% yoy in Q1 given that wage growth seems to have dropped slightly in Q2. Gross capital formation is likely to have accelerated, mainly due to a decline in capital goods prices. Government expenditure should pick up thanks to a surge in revenues.

Taiwan's Q2 GDP growth to dip below 1% temporarily

Tuesday, July 28, 2015 12:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX