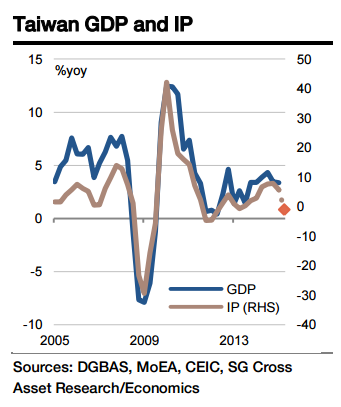

After seeing an exceptional decline in May, Taiwan's industrial production (IP) is expected to recover part of its strength in June. In May, the island's IP expanded by a mere 0.1% mom, the lowest growth rate seen since 1999. After seasonal adjustment, the outright declines in IP of more than 2% in two consecutive months were never seen before except during the two recessions in 2001 and 2008.

External demand has been soft in recent months, but it was not as dreadful as in the previous recessions when the average pace of declines in export orders was 20% yoy. In other words, IP growth in May was too weak to persist. However, given that there is an unfavourable base effect in June, IP is expected to have rebounded modestly to -1.1% yoy from -3.2% yoy in May. Still, IP growth will have declined sharply from 5.8% yoy in Q1 to -1% yoy in Q2, pointing to weaker Q2 GDP growth. At the same time, mild increases in wholesale and consumer prices likely favoured commercial sales in June. A slightly smaller decline in the headline figure is expected. Real retail sales are expected to have accelerated in June, given the tight labour market and slower imports of consumer goods.

Taiwan’s industrial production to recover from an exceptionally weak May

Monday, July 20, 2015 1:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed