Since the recent Fed commentary suggests that a September hike is unlikely, whether the Fed hikes later in the year would depend on the evolution of economic data, as well as financial conditions.

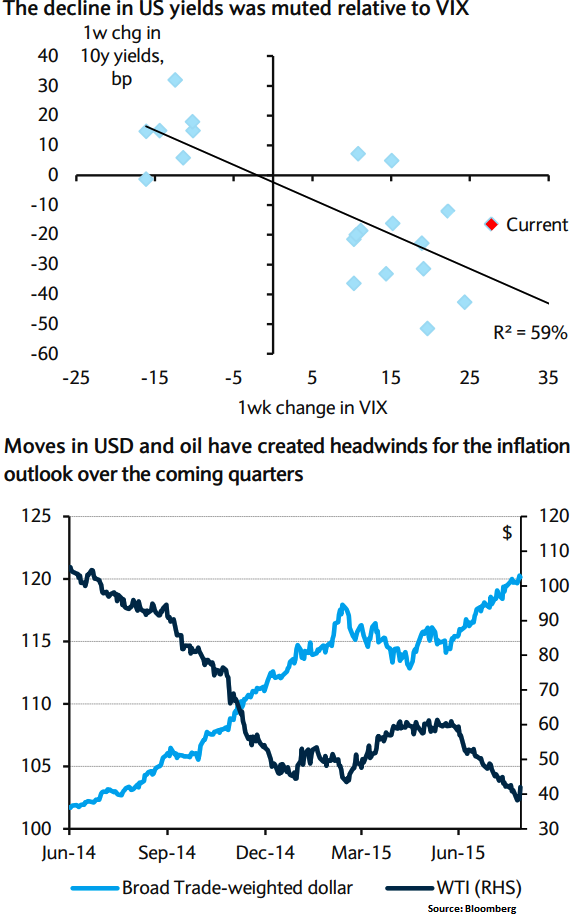

Given the recent increase in implied volatility and the Fed emphasizing a gradual path of policy, we recommend selling 3m5y straddles. The price action in the bond markets was relatively contained in the face of a sharp increase in risk aversion; even as VIX rose as high as 50pts, 10y US yields rallied only 10-15bp and failed to decline materially below 2% except for a brief period of time.

Recent dovish commentary from the Fed and the rally in energy prices have led to a rebound in risk assets from the lows. Even as 10y yields at 2.2% are only back to where they were early last week, the 5s30s Treasury curve has steepened sharply. Although the recent Fed hiking rate seems unlikely for now but whether the Fed hikes later in the year would depend both on the evolution of economic data and financial conditions.

The July FOMC minutes suggested that even before taking into account the decline in risk assets, there was no consensus to raise rates in September to begin with. "Some" participants argued that conditions to raise rates "might not soon meet" and "some" participants were confident that conditions for raising rates would be met shortly. Those who were not confident were likely worried about downside risks from energy prices and strengthening USD as "some members continued to see downside risks to inflation from the possibility of further dollar appreciation and declines in commodity prices." Since then, energy prices have fallen and USD has strengthened further, both creating headwinds for the inflation outlook over the coming quarters.

Tepid moves of 10Y US treasury yields on Fed’s dovish commentary

Friday, August 28, 2015 11:21 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth