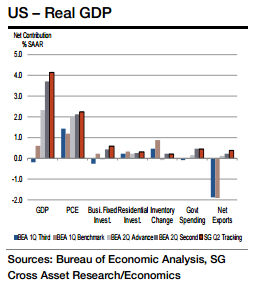

Data released subsequent to the Bureau of Economic Analysis' preliminary report on U.S. real GDP growth during the spring point to yet another markup. Stepped-up spending by consumers and businesses, along with a larger contribution from net exports, is expected to push the annualized growth rate four ticks higher to 4.1%, following a 0.6% rise in Q1, said Societe Generale in a research note on Friday.

The mix between final demands and inventories is expected to be even more favorable in this week's report. Real final sales of domestic product - inflation-adjusted GDP less the change in private inventories - likely expanded by 4.0% - the fastest clip since the summer of 2014, added Societe Generale. Flipping the signs on the US international trade accounts, real domestic demand growth probably will be boosted by two ticks to 3.5%, essentially matching the clip set over the four previous quarters.

Third time likely to be charm for U.S. Q2 GDP growth

Friday, September 25, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed