Today at 12:30 GMT, consumer price index (CPI) data will be released from US for April and that number will decide whether Dollar will move ahead with its breakout of month long down trend or crumble.

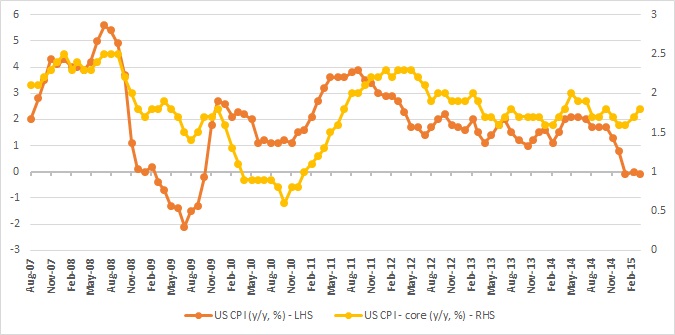

US inflationary trend -

- Headline inflation in US is hovering in negative territory as of now. In March headline CPI fell by -0.1%, however core inflation has remained stronger. In March headline CPI grew by 1.8%.

Expectation today -

- Today data is expected to be softer for April. CPI is expected to remain in negative territory on yearly basis and grow by 0.1% m/m. Core CPI is expected to remain stable on monthly basis growing at 0.2% and drop marginally to 1.7% on yearly basis.

Impact -

Weaker than expected CPI would surely create havoc for Dollar as inflation remains key concern of FED to consider any rate hike.

- Dollar index is currently trading at 94.95, down -0.46% today. Further loss is likely id CPI comes lower than expected.

- However, traders are likely to await to hear the speech of Janet Yellen, scheduled at 17:30 GMT, before pushing dollar to one direction based on CPI.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary