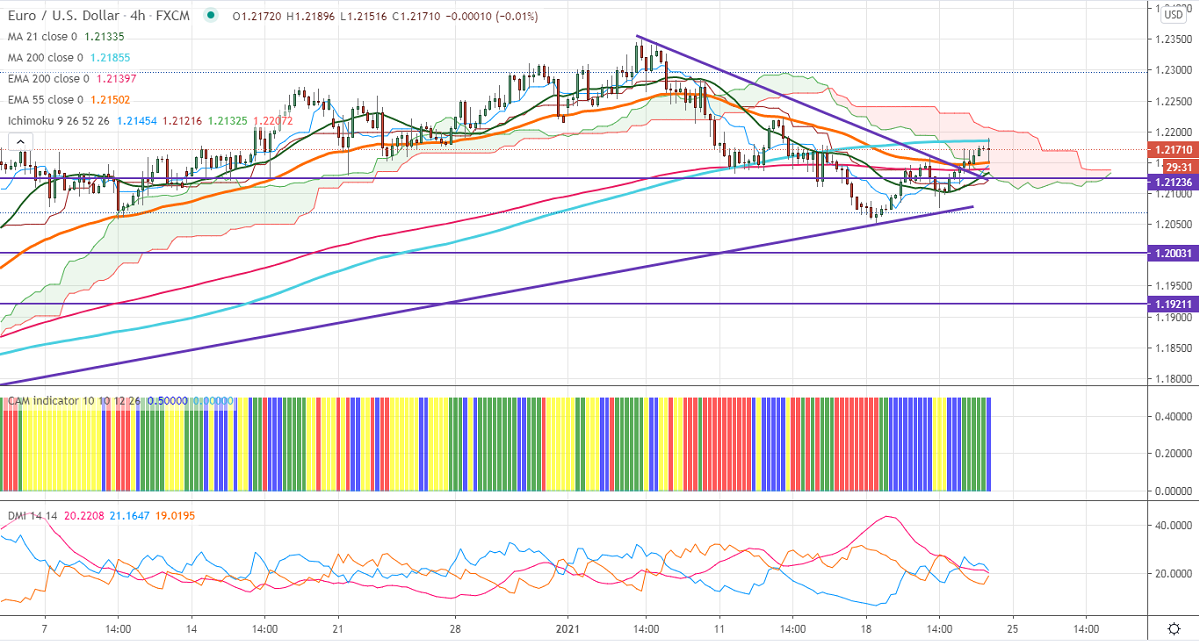

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.21383

Kijun-Sen- 1.21155

EURUSD recovered more than 20 pips from a low of 1.21514 despite weak PMI data. The flash Eurozone came at a 2-month low at 54.70 compared to 55.20 previous months. While German PMI falls to seven months low at 57 vs forecast of 57.30. Markets eye US existing home sales and flash manufacturing PMI for further direction.

Technical:

On the higher side, near-term resistance at 1.2200. Any indicative violation above targets 1.2260/1.2300/1.2345. The next support is around 1.21150. Breach below will drag the pair down till 1.20780 (trend line support)/1.2050/1.200.

It is good to buy on dips around 1.21480-50 with SL around 1.21150 for the TP of 1.2260.