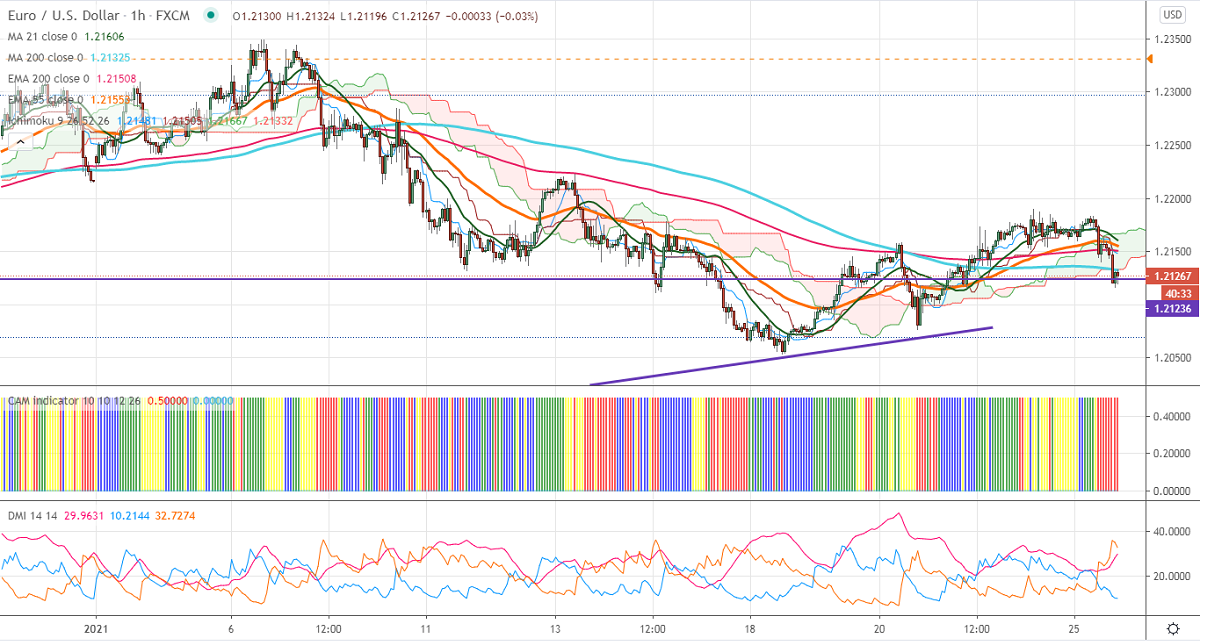

Ichimoku analysis (1-hour chart)

Tenken-Sen- 1.21495

Kijun-Sen- 1.21505

EURUSD declined more than 50 pips on weak German IFO business climate. The business climate declined to 90 in Jan compared to a forecast of 91.10. The surge in coronavirus cases and slight pessimism in Biden stimulus is supporting demand for safe-haven assets like yen. The pair hits an intraday low of 1.21160 and is currently trading around 1.21258.

Technical:

On the higher side, near-term resistance at 1.2150. Any indicative violation above targets 1.2180/1.2200/1.2260. The next support is around 1.21150. Breach below will drag the pair down till 1.20780 (trend line support)/1.2050/1.200.

It is good to sell on rallies around 1.2148-50 with SL around 1.2180 for the TP of 1.2050.