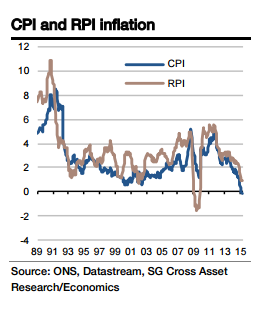

UK CPI inflation turned negative in April (-0.1% yoy) when an unchanged zero reading was expected. The point to note was that the reason for the dip was not a genuine reduction in price pressures.

Rather, it was an anomaly caused by the way the ONS samples transport fares and, as such, is likely to be at least partially reversed this month. That should result in core inflation bouncing from 0.8% yoy to the 1.0% yoy recorded in March.

In addition, petrol prices continued to rise in May, and much more strongly than a year earlier, which should contribute 0.07pp to the inflation rate. With food price inflation remaining close to last month's -2.8% yoy, the result should be a jump in inflation from -0.1% yoy to 0.1% yoy.

UK - Brief flirtation with negative inflation to end

Monday, June 15, 2015 1:10 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022