Oil has been down near about 50% since the summer of 2014. The reduction in oil price, we believe will be positive for the global growth-

- Oil deficit countries will be better off and have better balance of payments. Globally oil deficit countries are in far higher number than the producing ones.

- The global consumers will have better disposable income to drive up the consumption.

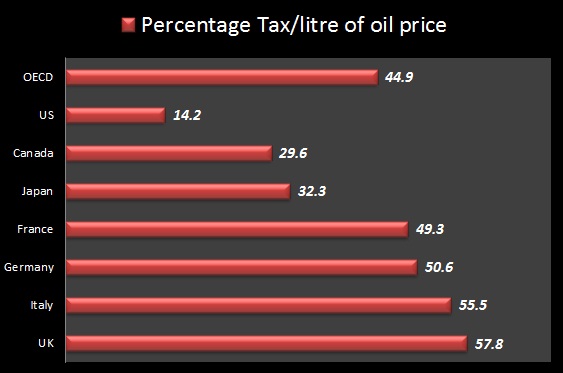

Nevertheless there are several downsides to lower oil price. Our research showed one of such could be oil taxes. This year the loss share of taxes are going to pinch the pockets of the government, reducing their tax revenues, should the reduction passes to the consumer.

- In this regard from the latest data available the share of the taxes per liter of oil price is very high in UK & Europe compared to North American counterparts. A table & a chart is included describing the tax's share.

- Some countries namely India have used the fall to the revenue advantage by very gradual reduction in end user price.

|

Country |

%Tax |

|

UK |

57.8 |

|

Italy |

55.5 |

|

Germany |

50.6 |

|

France |

49.3 |

|

Japan |

32.3 |

|

Canada |

29.6 |

|

US |

14.2 |

|

OECD |

44.9 |

Brent trading at 61.55 with + $8.7 spread over WTI. We remain bearish on oil over the coming months.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate