Global food price deflation pressures continuing to mount which should push down UK food prices as well so food deflation tis expected to deepen again.

Against that, petrol prices rose again in June and more strongly than a year earlier so making a positive contribution to inflation. Overall, the impact of commodity prices on the inflation rate should be zero. Core inflation should edge up.

"The June price data should show opposing influences cancelling each other out to leave the CPI inflation rate at 0.1% yoy", forecasts Societe Generale.

Goods inflation might stay at -1.2% yoy as the downward pressure from the strong pound continues but services inflation should increase slightly from 2.3% to 2.4% as the tightening labour market starts to have an impact. This should take core inflation from 0.9% to 1.0% yoy.

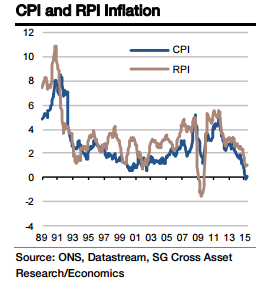

The combination of stable commodity price inflation and a slightly higher core inflation rate should impart an upside risk to inflation. It should remain at 0.1% yoy with a riskof 0.2% yoy. RPI inflation should rise from 1.0% to 1.1% yoy.

UK June inflation to be stable

Monday, July 13, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX