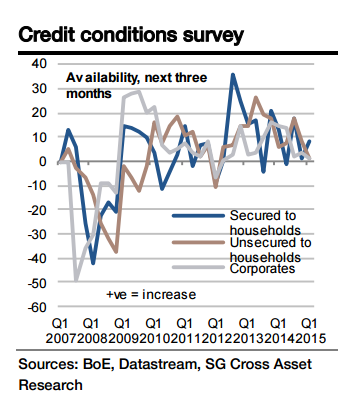

The Q1 Bank of England Credit Conditions survey reported that mortgage availability was broadly unchanged but that mortgage demand decreased significantly. This was somewhat surprising, given that consumer confidence was strong, real incomes were rising and mortgage rates falling. But for the coming three months, i.e. Q2, they expected a small pickup in availability and in demand.

The hard data up to May corroborate that forecast increase in demand but it is still not strong. The broad picture from the survey was that overall credit availability was only expanding gently in 2014 and this year after much bigger increases in 2012 and 2013. This is puzzling since the banking sector is healing in the sense of becoming better capitalized and its bad loan experience is improving.

"In the Q2 survey we expect banks to indicate that overall availability will again increase only slightly," said Societe Generale in a report on Monday.

UK credit conditions hardly changing

Monday, July 13, 2015 12:44 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed