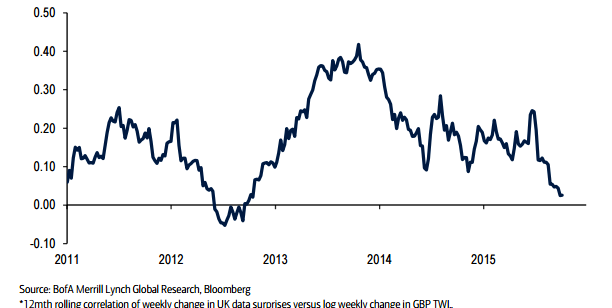

While the strength of the UK economy will ultimately drive the BoE rate decision, GBP is currently relatively insensitive to UK data surprises.The 12-month correlation between weekly log changes in the GBP TWI versus the weekly change in UK data surprises is below 0.20 level.

This suggests GBP TWI has become less correlated to UK data surprises in recent months and that this decoupling accelerated in recent weeks. The peak in the correlation coincides with the point at which the fortunes of GBP started to turn during the middle of Q3.

Price action following the weakest UK service sector PMI since 2012 was very telling. Following that reading, GBP traded broadly higher despite the initial knee-jerk sell-off and even managed to brush aside a more dovish tone to the Bank of England Minutes later in the week.

The GBP sell-off following the release of CPI data was, in our view, more a function of renewed market volatility than it was in reaction to the data. Indeed, short-sterling interest rate futures were only 1-2 ticks higher on the day.

"The correlation between the UK data and GBP changes would suggest that for now, the market has little interest in trading GBP on a policy divergence basis, particularly with the UK rates market pushing back the timing of the first UK rate hike well into 2016", says Bank of America.

It is doubtful that only at the point at which the marketsbecome fully engaged with the prospects for Fed tightening will they once again trade GBP on policy divergence themes.

UK data does not matter to GBP for now

Thursday, October 15, 2015 5:56 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022