UK labour market is at a crucial juncture. Earnings growth seems to be picking up, as one would expect as the output gap closes, but employment growth has started to falter.

"Rising earnings growth is seen as a lagged response to the diminishing output gap so a further increase is expected in regular earnings from 2.8% to 2.9% 3mth yoy and in total earnings from 2.4% to 2.5% 3mth yoy", says Societe Generale.

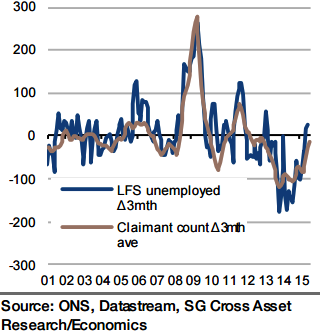

A key uncertainty is the state of employment. The most recent peak in 3mth/3mth growth was 0.8% in February but by June it had fallen to -0.2%. Is this a trend or is it a temporary effect caused by uncertainty about the likely outturn of the May election? If it is the latter then an improvement should be soon seen.

However, even if that is correct, the reported data for July could still show a fall because the survey used to collect the data is a rolling three month survey so a one month shock would be felt in the data for three months to some extent.

UK earnings growth rising, unemployment rate steady at 5.6%

Wednesday, September 16, 2015 5:21 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed