The United Kingdom’s manufacturing sector started the final quarter of the year on a solid footing. Production and new order volumes continued to rise at robust rates, as companies benefited from strong domestic market conditions and rising inflows of new export business.

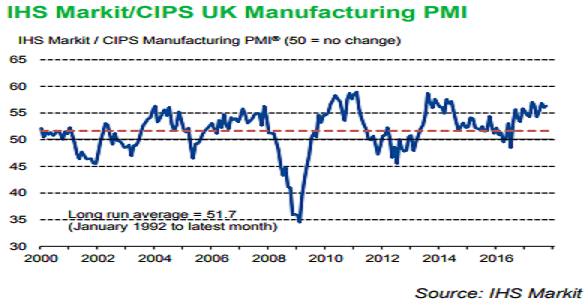

The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index (PMI) registered 56.3 in October, up from 56.0 in September (revised from the original reading of 55.9). The headline PMI has now signaled expansion for 15 consecutive months. Responses from the latest survey were collected between October 12-26.

UK manufacturing production rose at an identically solid pace to that registered in the prior survey month during October. The expansion was broad-based by sub-sector, with consumer, intermediate and investment goods producers all registering output growth.

"The continued robust health of manufacturing and rising price pressures will help cement expectations of the Bank of England hiking interest rates for the first time in a decade as Thursday’s announcement approaches," said Rob Dobson, Director at IHS Markit.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady