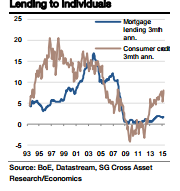

The current strength of UK consumer demand has been fuelled by rising real incomes but also by strong consumer credit growth. In contrast, whilst consumer confidence is at very high levels, it is striking that mortgage activity has only responded in a relatively muted fashion.

"The contrast is expected to have continued in the May data. Net consumer credit should repeat the April gain of £1.2bn but mortgage approvals should only manage a very modest increase from 68.1k to 69.0k", says Societe Generale.

Broad money growth on the M4 ex IOFC measure should remain strong at around 4%, 3mth pa, added Societe Generale, consistent with strong growth in underlying economic activity.

UK money and credit data to reiterate healthy activity trends

Monday, June 29, 2015 5:24 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX