The market has pared back expectations of BoE tightening ahead of the August policy vote, which may well be split. Short-dated GBP rates have room to cheapen should the Inflation Report be hawkish, but this would be hard to reconcile with soft core inflation.

Thursday 6 August will be a significant day for UK markets, as it will see the MPC policy decision, minutes and the latest quarterly Inflation Report (QIR) published concurrently at noon for the first time. The press conference that previously began shortly after the publication of the QIR at 10:30 under the old regime will now be held at 12:45. For the market, the release of the minutes alongside the policy decision is probably the most significant change as market participants will no longer have to wait several weeks to find out how individual MPC members voted. This could prove particularly relevant at the forthcoming meeting, which may see the first split vote since December.

The July MPC meeting minutes noted that for "a number" of members, the balance of risks to medium-term inflation relative to the 2% target was becoming more skewed to the upside at the current level of Bank Rate and that for them the decision was finely balanced but for developments in Greece. In June, the decision was reported as finely balanced for only two members. Martin Weale is expected to vote for a rate hike at the August meeting, with risks of other members following suit. Other potential candidates to vote for a rate hike include Ian McCafferty and possibly either David Miles or Kristin Forbes. A vote for a hike by Mr Miles would likely be discounted by the market given this will be his last MPC meeting.

The main change since the July meeting has been the resolution of significant uncertainty related to Greece. From a global perspective, the volatility in China equity markets remains a potential source of concern. From a purely domestic perspective, the need to tighten policy does not appear especially pressing. UK core inflation fell to 0.8% y/y in June, the lowest print since 2001.

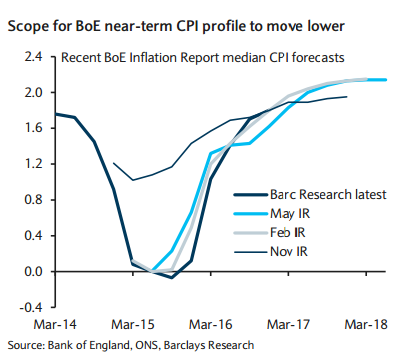

"While the set of y/y CPI prints since May has been consistent with the BoE near-term forecast, we see risks that the QIR CPI projections for 2015 will move lower to reflect the 20% fall in GBP-denominated oil prices since May," notes Barclays.

UK rates: Weekly review

Friday, July 31, 2015 12:25 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed