In the wake of the raft of Bank of England communications at the August MPC meeting, the central view of the timing of the first UK Bank Rate rise is shifted from November 2015 to February 2016. Despite earlier speculation that up to four members of the Committee would vote for an immediate 25bp hike at this month's meeting, in the event there was only one dissenter - external member, Ian McCafferty. While 'some' members of the MPC felt the stronger demand outlook presented an upside risk to inflation, for most, the inflation outlook was believed to be more benign. Oil prices have fallen back below $50/barrel, raising concerns that this may reflect a broader weakening in global demand; the pounds trade-weighted exchange rate has surged to a seven-year high, putting further downward pressure on UK import prices; and productivity has finally started to show signs of life. The implication of these events suggests that inflation, at least in the short term, is likely to remain lower for longer.

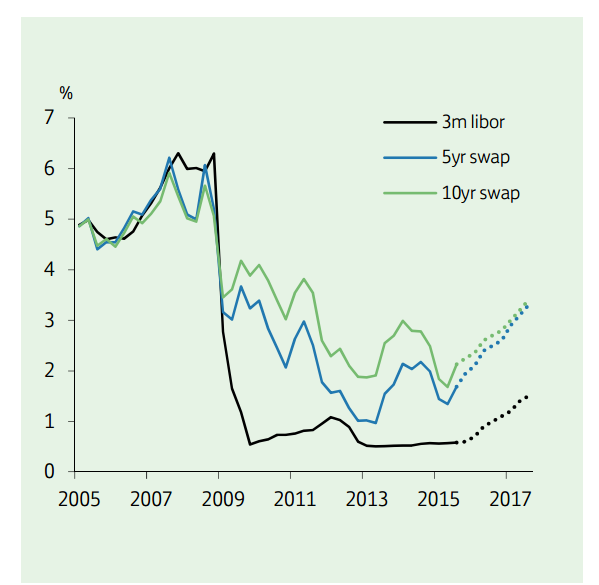

For now, the majority of MPC members appear to be attaching significant weight to these heightened downside risks to inflation. Although, the latest Inflation Report reported the Bank's 'best collective judgement' that annual CPI will be modestly above the government's 2% inflation target at the end of the forecast horizon, the near-term profile is appreciably softer. The arguments for hiking interest rates sooner rather than later remain compelling and could reduce the need for a more aggressive pace of tightening later - particularly if, as expected, the US Fed raises interest rates next month. For the majority of the MPC, however, there is clearly less urgency and the MPC's latest forecasts and narrative suggest that the MPC will now wait until the first half of next year to start raising interest rates - most likely until February. By then, some of the relative price shifts that have kept inflation in check should have started to unwind, the economy should have recorded two more quarters of decent growth and some of the international concerns should have dissipated. The gradual normalisation of UK & US monetary policy is forecast to push yields higher over the medium term.

"We forecast a rise in 10-yr gilt yields to 2.2% by year end and to 2.7% by end 2016," says Lloyds Bank.

UK rates review

Thursday, August 13, 2015 12:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX