The LFS unemployment rate should continue on its downward path, dropping from 5.5% to 5.4% in the three months to May. The new claimant count which now includes claimants of Universal Credit as well of Jobseekers' Allowance should lose 6k in June after 6.5k in May. There is a clear picture emerging in the claimant data of a cooling of the downward trend in unemployment and that might soon manifest itself in the LFS data as well. The main interest will be in the average earnings data.

Societe Generale notes:

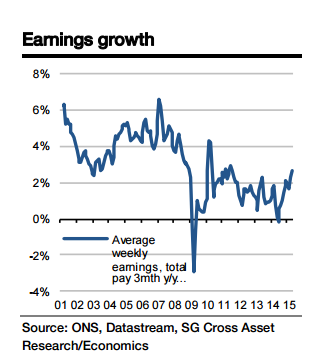

We are starting to see an acceleration in both regular and total pay. Growth in regular pay has picked up sharply in the last three months from 1.6% yoy in January to 2.9% yoy in April.

We expect it to hold at that level in May which will increase the 3mth yoy headline rate from 2.7% to 2.9%.

We expect no increase at all in bonuses compared to a year earlier. One would then expect that the headline rate of total pay growth would match that of regular pay but, because of quirks in the way seasonal adjustment is applied, total pay growth should jump from 2.7% to 3.3% 3mth yoy. This will be taken as a very hawkish development by the markets.

UK total earnings growth to rise strongly

Monday, July 13, 2015 2:04 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022