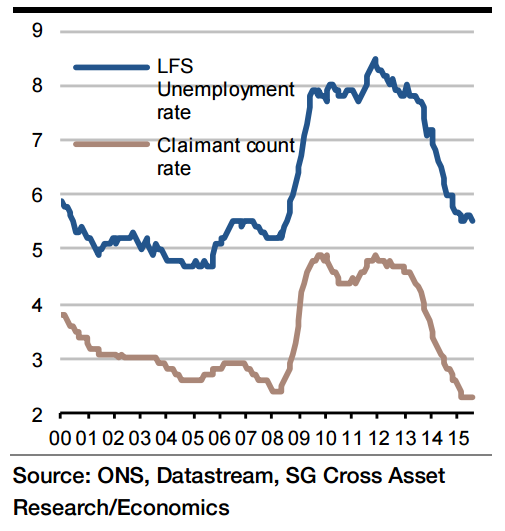

Employment growth ground to a halt in the three months to May. Indeed, it actually fell by 0.2% 3mth/3mth. A small part of that weakness may have been caused by uncertainty surrounding the election because we have seen a small recovery in job creation subsequently.

However, there seems to be a more deep-seated weakness, probably symptomatic of some weakening of demand and an increase in productivity, so the return to positive employment growth should only be muted. Only modest job gains are expected in August so, with continuing growth in the labour force, unemployment should rise again and the unemployment rate should increase from 5.5% to 5.7%. The claimant count should fall by 3k after an increase of 1.2k in August.

Earnings growth should continue to accelerate. Pay excluding bonuses should rise from 2.9% to 3.0% 3mth yoy in August. Bonuses have been growing more strongly than regular pay which should result in total pay growth rising from 2.9% to 3.1% 3mth yoy.

UK unemployment rate and earnings growth to rise

Tuesday, October 13, 2015 11:39 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022