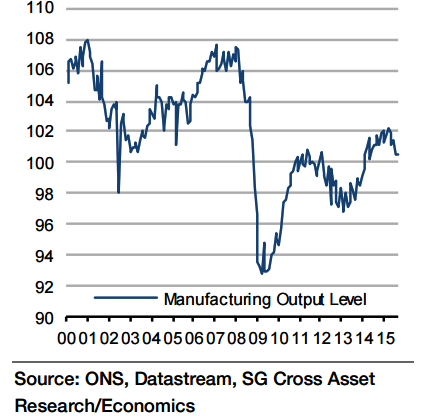

The sector appears to be weakening with surveys showing significant declines from the peak readings of 2013 and 2014. However, the output indices within the surveys still signal positive output growth which does not fit with the official data.

At the very least there has been a loss of momentum which is attributed to the recent falls in export orders. The survey output indices have been stable since April yet by July the level of output had fallen by 1.3%.

"Moreover, it has also been highly volatile, falling by 0.8% mom in July. That exaggerates the slowdown, and so a bounce of 0.4% mom is expected in August", says Soceite Generale.

UK's manufacturing sector to recoup some of the July fall

Wednesday, October 7, 2015 5:26 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed